It can be exciting to buy your first car, but a lot has to be done. Planning for the future will make the process smoother — and help you get the right car for you. Here are a few essential items to consider while shopping for your first ride.

- Be honest about your needs, and what suits them: Do you need a car to attend school or work every day or only for your weekend adventure? Assess your drive and your lifestyle most often. Learn about various features and alternatives and how they can impact a vehicle’s price.

- Think of your budget and your financing: Look at your finances realistically as well. This does not include the purchase price alone but budgets for your future vehicle, including operation, insurance, gas, maintenance, and parking. Learn how much a car is costly. You don’t usually need to pay for your loan, but having it typically is a good idea — you won’t have to borrow as much as you will have to lower your monthly payment.

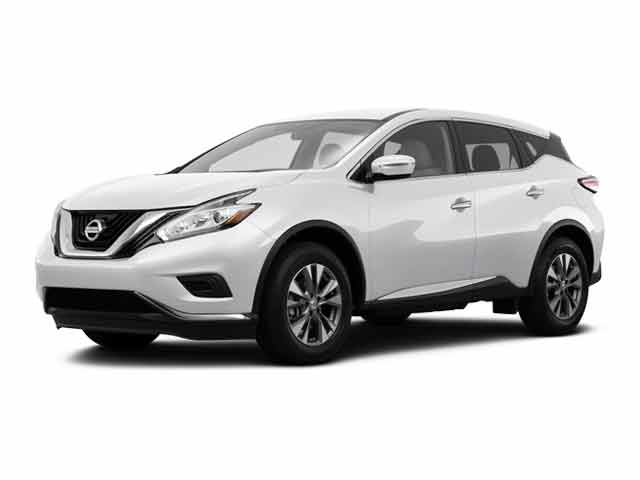

- Explore your choices: It is much easier for you than for your parents to shop for your first car. The internet offers many sellers outside your area, which can make your price range more option. By looking at car rankings in categories such as safety or car type, you can investigate and limit choices (such as SUVs, hybrids). Figure out how to purchase a car online – and even fund it. Ask many dealers for offers for new vehicles, or you can even opt for used ones from used cars in san diego.

- Know your credit score: Your credit score helps decide how much interest you pay on a car loan. Know your credit score. Better loans will help to put your total car buy budget at a more attractive interest rate. You can also get a free credit score through your credit card provider. Before you are ready to buy, review your credit report to allow time for your credit score to improve.

- Request for a loan option: Shopping for a car loan may seem counterintuitive before shopping for a car, but it is beneficial. You get a sense of how big or small you can borrow, so you don’t have to fund your fly at the dealer. Start at your bank or credit union and get quotations from other lenders to ensure the best rate is obtained.

- Take a road test: Once you have found a few cars that could meet your needs and budget, you can take a test drive each to see how and how you feel. Try to drive any vehicle you like on that day so that you can compare it easily. Calling for appointments to plan this day is a smart idea—and lets you evaluate each dealer’s customer service.

- Close the deal: You’ve researched, you know what you want, and you’re funded. You are in charge and should concentrate on reading the contract carefully when it’s time to discuss the offer. However, be sure to consider the terms and conditions of all funding and guarantee arrangements before you sign.

Make sure that you can never skip a car payment by subscribing to an automatic bill so that you can concentrate on your next destination.